Brexit Would Be Bad For Businesses, Big And Small

Today I take a look at big-picture economics and politics, and ask how it all affects the small and medium-sized enterprises whose funding Money&Co. facilitates by means of peer-to-peer (P2P) business lending.

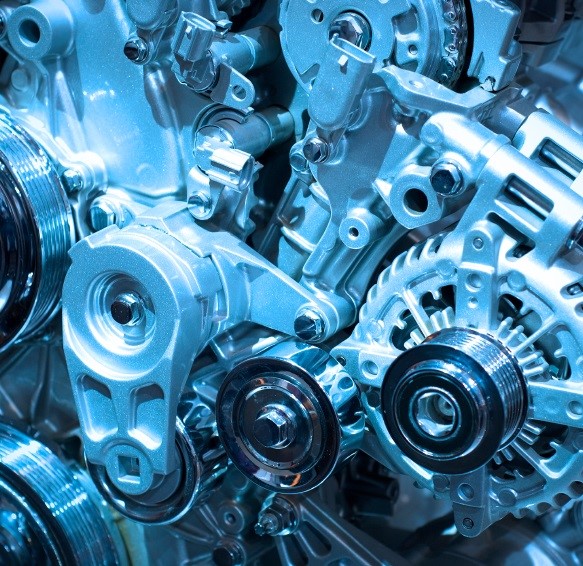

One of the great economic successes for the UK over the last twenty years has been the revival of the British car industry. In 2013, the car industry turned over £61 billion and employed 720,000. Nissan and Honda have invested heavily in the UK, using us as their base to manufacture in the EU. Ford and General Motors have also remained in the UK and invested more over the years. In addition, great British brands like have been bought by BMW (Mini and Rolls-Royce) and Tata (Jaguar and Land Rover).

In 2015, 1,682,156 cars and commercial vehicles were manufactured in the UK, making us the 13th largest car manufacturer in the world and the fourth-largest in Europe behind Germany, Spain and France. Nearly 80 per cent of the vehicles manufactured here are exported with half of these going to the EU. One of the big questions that needs to be addressed in the EU referendum debate is how Brexit would affect the car industry.

“Leaving the EU and relying on WTO status would be disastrous…”

The EU imposes a 10 per cent tariff on foreign car imports and a 5 per cent tariff on automotive components. This would make British made cars uncompetitive and would be likely to result in foreign manufacturers moving production from the UK to Germany, Spain and France. Brexit campaigners say that we would be able to rely on our membership of the World Trade Organisation (WTO) to secure access to the single market, but we would be likely to still face tariffs.

The car industry is just one example of an industry where major multi-national corporations have used the UK as a base to access the single market, which has been greatly to the benefit of the UK economy. The other obvious example of an industry that has chosen the UK as its base is financial services.

This is, however, an industry that still hasn’t benefited fully from our EU membership as the single market is not complete for services. In order to get the full benefits of membership, we need to stay in the EU and lead the push to get the single market completed. We have the most to gain as 78 per cent of our GDP relates to services. If we leave and rely on our membership of the WTO, this will be disastrous for the services sector as the WTO has made very little progress in its negotiations with the EU in this area.

Much of the argument to date on the EU referendum has focused on what we might lose if we leave. More emphasis needs to be placed on what we will gain if we stay in and push for the completion of the single market.

You may be asking what this has to do with SMEs and Money&Co. There are many smaller businesses that manufacture components for the motor industry, which may well suffer if we leave. And there are enormous numbers of small financial services businesses that could very well benefit if the single market were completed. Money&Co. itself has shied away from expanding into Europe, but we would consider doing so were the single market completed.